CBO's Revisions to the Budget Outlook Are Sobering

The New Deficit Projection for FY 2024 Is $1.9 Trillion

The Congressional Budget Office (CBO) has released a revised ten-year budget outlook, and the news isn’t good. The agency released projections in February. While horrible, those numbers were “better” than some of us expected. The budget deficit in FY 2024 was projected to be $1.507 trillion. The new projections show an upward revision in the budget deficit of nearly $408 billion, bringing the projected budget deficit to $1.915 trillion.

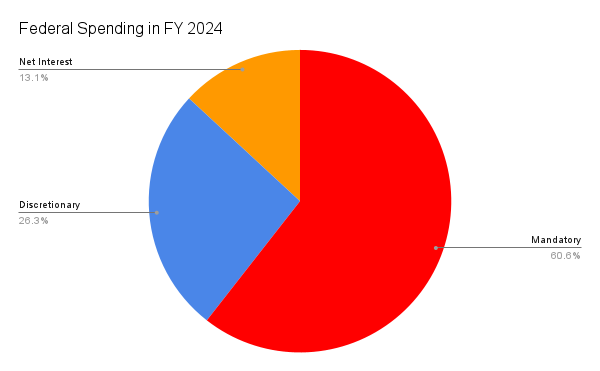

So, what happened? In FY 2024, the main driver is mandatory spending. Mandatory outlays as a percentage of gross domestic product (GDP) are projected to rise from 13.6 percent to 14.5 percent. Discretionary outlays are projected to rise from 6.2 percent of GDP to 6.3 percent.

The sharp increase in spending in FY 2024 is mostly based on higher than previously projected spending for student loans, the FDIC not recovering payments, increased discretionary outlays, and increased Medicaid outlays. Increased discretionary spending represents $57.3 billion of the $362.5 billion upward revision between the February 2024 and June 2024 reports.

Looking ahead to FY 2025 through the ten-year budget window, the driver of the spending increases is because of projected increases in discretionary spending. Now, this is the spending that Congress controls. The reason for the upward revision is the assumption that emergency supplemental appropriations passed in April will continue in future years. Although it’s possible that some or all of that spending will continue, it doesn’t seem likely considering that another round of emergency supplemental appropriations is based on a number of factors that aren’t clear and may not be clear for quite some time.

As a result, the budget deficit is projected to be $2.232 trillion higher over the ten-year period, with about 58 percent of that attributable to discretionary spending. Even with the upward revision in discretionary outlays, Congress will spend less as a percentage of GDP for this budgetary category than it did in FY 1997 (6.5 percent) and only slightly more than it did in FY 1998 (6.2 percent).

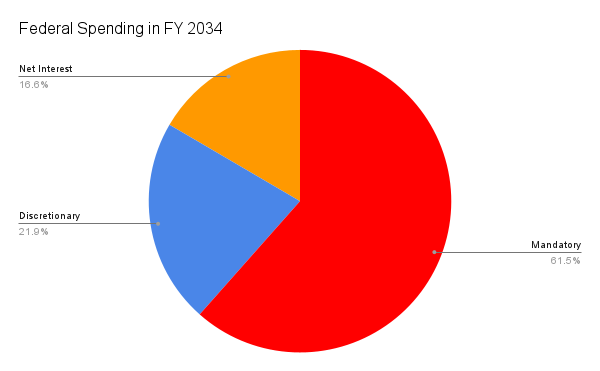

Over the next ten years, discretionary outlays are still projected to decline to lower than any point since FY 1962 (as far back as CBO's historical figures show), dipping to 5.5 percent of GDP in FY 2034. The previous projection was 5.1 percent. That would be better, of course, but we're still talking about historical lows. (Since the nature of the federal government changed during World War II, the term “historical” needs perspective. We’ll say 1941, although 1942 was really when we ramped up. Before World War II, federal spending as a percentage of GDP topped out at 10.6 percent of GDP. That was in 1934. In 1930, the federal government spent 3.4 percent of GDP; the equivalent of $958 billion in FY 2024.)

It’s also worth repeating that Congress could eliminate all discretionary spending in FY 2024 and still run a $120 billion budget deficit. In FY 2034, Congress would still run a $603 billion budget deficit. Cut all nondefense discretionary spending, leaving only defense, the deficit would be $1 trillion in FY 2024 and $1.7 trillion in FY 2034.

Mandatory outlays are nearly 61 percent of federal spending. We’ve seen mandatory outlays rise from 9.8 percent of GDP since FY 1995 to a projected 14.5 percent in FY 2024. In FY 2034, that figure will rise to 15.2 percent. In FY 2023, Social Security, Medicare, and Medicaid accounted for 74.4 percent of mandatory spending. In FY 2034, those programs are projected to be 81 percent of mandatory spending and 61.5 percent of all federal spending.

The growth of expenditures for net interest is even more alarming than the growth of mandatory spending. The differences between the February 2024 and June 2024 reports aren’t massive. Historically speaking, going back to FY 1995, the growth is shocking. In FY 2025, outlays for net interest will surpass the primary budget deficit. (The primary deficit excludes outlays for net interest.) In FY 2024, 47 percent of the budget deficit is net interest. That is projected to jump to 60 percent in FY 2034. So, in effect, we’re borrowing money to pay for the money we’ve borrowed.

It’s quite shocking when you realize that Congress argues about 26 percent of federal spending every year but ignores the other 74 percent. The former is discretionary outlays while the latter is mandatory spending and net interest.

The share of the national debt held by the public is projected to rise from 99 percent in FY 2024 to 122.4 percent in FY 2034. It’s another alarming statistic, for sure. Although the United States has more elasticity than other countries that have experienced sovereign debt crises, the Economic Policy Innovation Center (EPIC) argues that we’re running out of fiscal space because of our deficits and debt and that we may reach the point of no return in 2035. For context, EPIC’s paper is based on the February 2024 CBO report.

Tax revenues have been projected downward, from 17.5 percent of GDP to 17.2 percent. This is because of a downward revision of $22.3 billion in individual income tax receipts and $43.3 billion in corporate income tax receipts. Tax receipts were also revised downward in FY 2025 and FY 2026, although marginally so. Revenues were revised marginally upward in all but one year after FY 2026.

Revenue assumptions are based on current law, which includes the expiration of the Tax Cuts and Jobs Act at the end of tax year 2025. The extension of the tax cuts is a policy priority of congressional Republicans if they keep the House, take the majority in the Senate, and win the White House. However, with the fiscal outlook so exceedingly bleak, tax cuts without major spending reforms, like the modernization of Social Security and Medicare, are tough to justify.