Conservatives Have to Talk About the Drivers of Federal Spending

It's Not Enough to Say the Issue Isn't Taxes

While scrolling through Twitter on Thursday, I stumbled across a tweet in which the author wrote several times in her post, “The issue isn't taxes, it's spending.” The tweet was amplified by Grover Norquist of Americans for Tax Reform, who simply wrote, “Repeat.”

Now, I like Mr. Norquist, who is the leading voice in the United States against tax increases, and I tend to agree with his views that tax increases hurt economic growth, investment, savings, and productivity. There’s a lot of misinformation about income taxes and who pays it. However, I get frustrated with conservatives when they talk about spending without defining what they mean when they talk about spending cuts.

My better half, Emily, and I discussed taxes yesterday because of the Democratic National Convention. I had expressed frustration with Vice President Kamala Harris’s tax proposals and Governor Tim Walz’s record on taxes in Minnesota. Harris’s tax proposals, at least what we know about them, are pretty bad while Walz may actually be worse, although on a smaller scale. Walz was given an F on fiscal policy by the Cato Institute. One of the reasons for this poor score is that he proposed massive tax increases at a time when his state had a budget surplus. Making your state less attractive to its citizens and businesses doesn’t seem smart when the state’s population is already declining.

But I digress. Emily asked me who pays income taxes in the United States. Data from the Internal Revenue Service show that the top 3 percent of income earners pay 52.1 percent of all income taxes while earning 29.7 percent of all adjusted gross income (AGI). The top 3 percent have an average effective tax rate of 23.3 percent. The top 3 percent has an average AGI of about $185,000.

Historically, income tax revenues are projected to be higher over the next ten years than almost any other time since FY 2001. The only exception is in FY 2022 when the economy was finally recovering from the COVID-19 pandemic and individual income tax revenues soared. The projections are also higher than at any point when the United States had top marginal income tax rates exceeding 90 percent. Individual income tax receipts are projected to be above 9 percent of GDP after FY 2025.

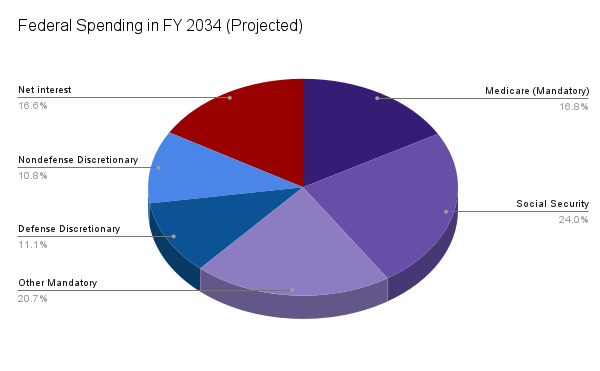

But let’s get to spending. Looking at the numbers from the Congressional Budget Office, federal spending as a percentage of gross domestic product (GDP) will rise from 22.7 percent in FY 2023 (actual final figure) to 24.9 percent in FY 2034 (projected). Average federal spending from FY 1981 through FY 2020 was 20.8 percent of GDP.

Although revenues will rise, particularly if provisions of the Tax Cuts and Jobs Act set to expire at the end of tax year 2025 do indeed lapse, revenues as a percentage of GDP will rise from 16.5 percent of GDP in FY 2023 to 18.0 percent in FY 2034.

The increases in federal spending aren’t coming from the discretionary side. In fact, discretionary spending is projected to decline from 6.4 percent of GDP in FY 2023 to 5.5 percent in FY 2034. As I’ve mentioned before, the spending that Congress argues about every year is discretionary. It’s subject to appropriation. This is the process that Congress goes through every year to pass the 12 regular appropriations bills. When there’s a threat of a partial or full government shutdown, it’s because Congress has failed to pass one or more or all appropriations bills.

Prior to FY 1975, most federal spending was discretionary. In FY 2023, only 28 percent is discretionary, and that figure is declining because of the growth of mandatory programs and net interest. The chart below shows the progression.

And this chart zooms in on FY 2023 through FY 2034.

I agree with the notion that spending is the problem. Spending is far outpacing revenues, both currently and over the long term, but it’s not because of discretionary spending. You can see the growth of federal spending comes from mandatory outlays—predominately Social Security and Medicare because of our aging society—and net interest.

What those who talk about spending never seem to mention is what’s driving spending. They either don’t get into details or gaslight people by talking about “woke spending.” Get real. Nearly all “woke spending” is on the discretionary side. Cut all the woke spending you want, and you’re talking about a rounding error in the federal budget. Congrats, you haven’t done anything to actually address the problem.

We’ve got to talk about the drivers of federal spending and how to modernize those programs. It’s a conversation that we need to have with the public, and it’s a conversation that too few are trying to have.