Final CBO Estimate Shows OBBBA's Impact on the Deficit

The estimate is $3.4 trillion added to the deficit over ten years, excluding interest, but it's likely to reach nearly $4.1 trillion

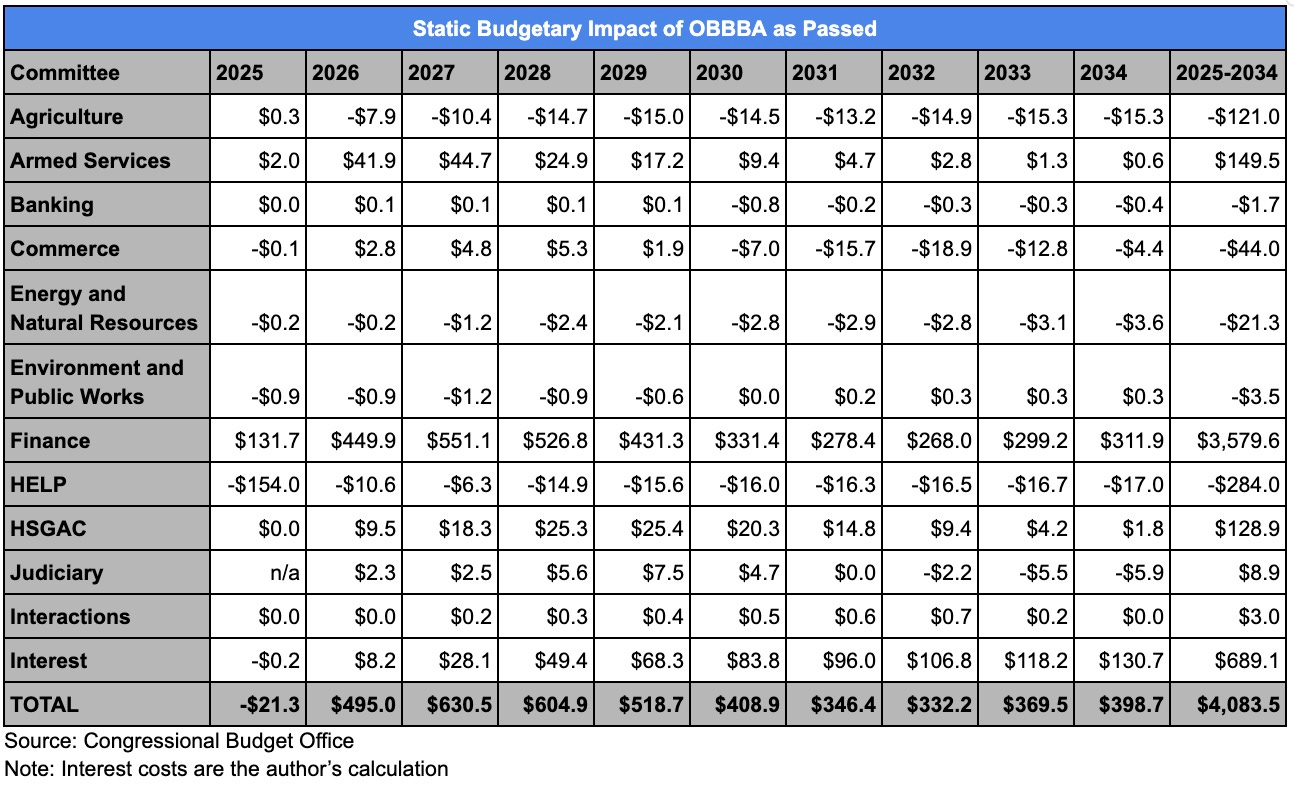

The Congressional Budget Office (CBO) has finally released its final projections of the budgetary impact of the so-called “One Big Beautiful Bill Act” (OBBBA), H.R. 1. Although OBBBA is projected to reduce outlays by $1.091 trillion from FY 2025 through FY 2034, it will also reduce revenues by $4.486 trillion. The estimate doesn’t include interest costs, but we’ll try to provide an estimate based on CBO’s handy interactive worksheet.

The reductions in outlays remained backloaded in the final version of OBBBA as passed by Congress and signed into law. Only 19 percent of the spending reductions will happen from FY 2025 through FY 2029. The remaining 81 percent of the spending reductions occur from FY 2030 through FY 2034. That’s assuming these reductions take place. Sen. Josh Hawley (R-MO), for example, has already introduced legislation to repeal the Medicaid provisions of OBBBA. With these provisions being backloaded, a future Congress and White House could indeed nix them, thus significantly increasing the deficit.

Of course, the estimate released by the CBO isn’t based on the macroeconomic effects of OBBBA. Sure, OBBBA may generate some economic activity, but it will almost certainly fall far short of the 2.6 percent to 3 percent economic growth target set by congressional Republicans and the White House.

It’s also important to note that at least 16 revenue provisions will expire beginning tax year 2029. If those provisions are extended, the deficit projection will exceed $5 trillion. We’re also assuming that the increased Defense and Homeland Security spending in OBBBA doesn’t create a new baseline. That would also increase the deficit under OBBBA. The deficit impact could be $5.5 trillion when it’s all said and done.

Republicans Will Continue to Cast Doubt on CBO

Republicans continue to criticize the CBO for “overestimating” the budgetary impact of the Tax Cuts and Jobs Act of 2017. Take, for example, this recent piece by former House Speaker Newt Gingrich (R-GA). “The CBO overestimated the cost of the 2017 Trump tax cuts by $1.5 trillion,” the former Speaker writes. “CBO and the Joint Tax Committee projected that eliminating the death tax would cost over $600 billion over ten years, despite the tax generating less than $34 billion annually.”

Interestingly, TCJA didn’t repeal the estate tax, and, of course, Gingrich didn’t provide any sources. Looking at the Joint Committee on Taxation’s estimate for TCJA, the only estimate related to the estate tax is the doubling of the exemption for it, the gift tax, and the goods and services tax. That provision increased the deficit by $83 billion over ten years.

Look, I’m not here to defend the CBO. I worked on the American Health Care Act (AHCA) in 2017 and remember screaming every time I saw a CBO projection that the bill would increase the number of uninsured people. That was coming from CBO’s estimates of enrollment in the health insurance exchanges created by the Affordable Care Act. I could go back to show you those estimates compared to reality, but it’s not worth the time or energy. Let’s just say CBO dramatically underestimated the number of people who would enroll in health insurance on the exchanges. CBO used those overestimations when calculating the supposed coverage losses under ACHA.

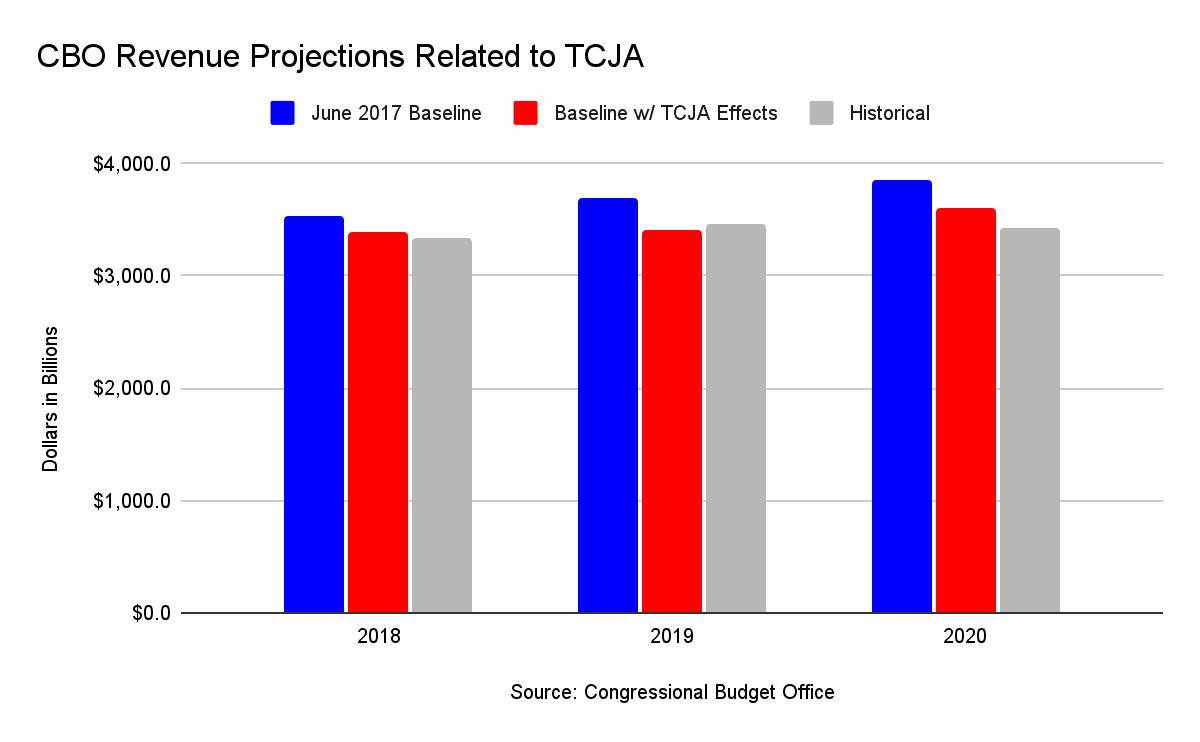

To Gingrich’s bigger point about the CBO overestimating the budgetary impact of TCJA. During the first two years of TCJA, the CBO was remarkably close to accurate. I’ve included FY 2020 in the chart below, but I don’t think it’s fair to compare FY 2020 or any year after it because of the global pandemic, which leads me to a broader point.

We often hear that tax cuts, such as the TCJA, pay for themselves. This has been one of the big selling points of OBBBA. It’ll generate growth and, therefore, larger receipts to the federal government. CBO’s projections of economic growth were off slightly in FY 2018 and FY 2018, by $514.4 billion and $615.4 billion, respectively.

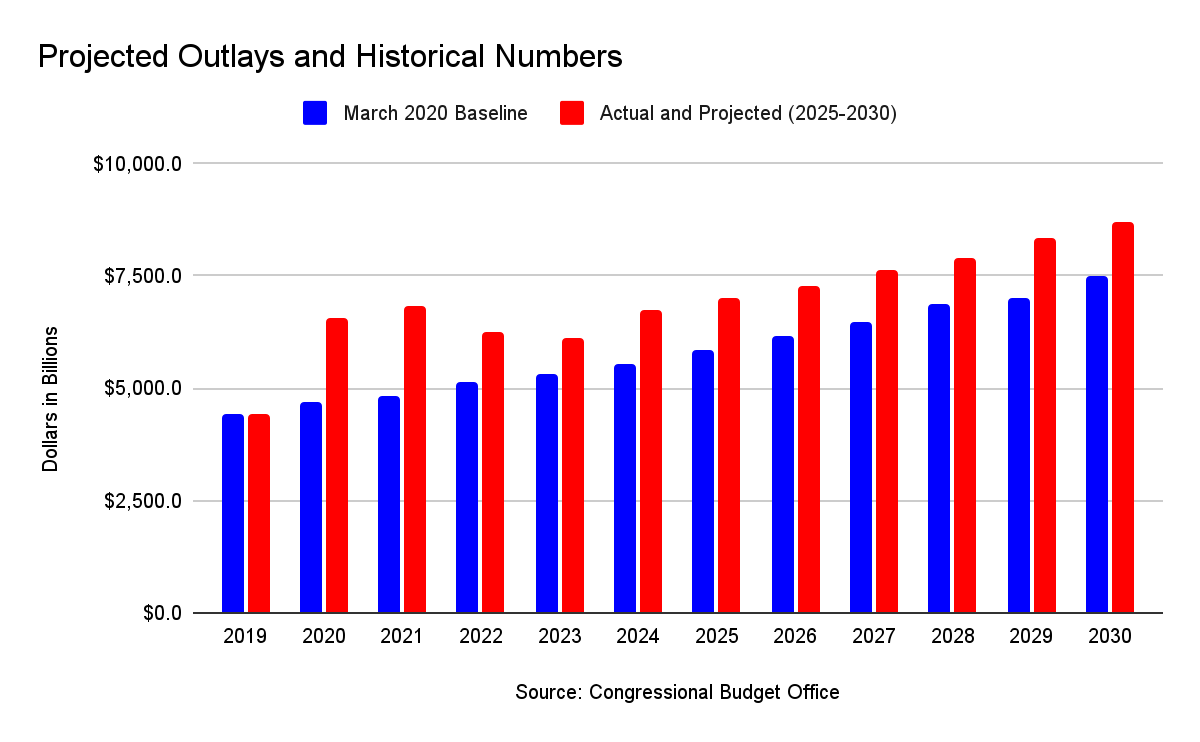

What CBO didn’t account for in its June 2017 baseline was pandemic-related spending and the post-pandemic economic recovery. Federal outlays in FY 2020 and FY 2021 were $1.848 trillion and $2.005 trillion higher than the CBO originally projected. Federal spending was still $1.155 trillion higher than the March 2020 baseline in FY 2022, $815.6 billion higher in FY 2023, and $1.228 trillion higher in FY 2024. Federal spending is expected to remain an average of $1.162 trillion higher than the March 2020 baseline through FY 2030.

Why does this matter? Well, for starters, all government spending–including federal spending–is included in CBO projections. So, when I look at the numbers showing that GDP is higher than CBO projected, I recognize that anywhere from 24 percent to 47 percent of that increase in GDP comes from increased federal spending. Some may say that the rest of the GDP increase comes from TCJA. No, it doesn’t, because every single person who worked on or lobbied for this bill knew that it was written so that the growth would be frontloaded. That was for political effect.

The CBO isn’t perfect. The agency is Republicans’ enemy when they’re trying to push a big bill through and their friend when it’s a bill they oppose. It’s more than a black-and-white issue when it comes to analyzing TCJA. OBBBA, though, could have a bigger negative impact on budget deficits than its supporters want to admit.