Misinformation from Both Sides on Republicans' Tax Plan and the Budget Resolution

Literally Everyone Is Being Dishonest About These Issues

Over the past several months, I’ve spent substantially less time on Facebook and Twitter and more time on Reddit. Has that change of behavior stopped me from doom-scrolling? Absolutely not. I still do that, but I tend to like the content I see more on Reddit than elsewhere because the subreddits to which I subscribe are more geared towards my interests. I still see a ton of political content, but it’s easier to ignore when I disagree with it.

“Where are you going with this, Pye?” you ask. I’m getting there. Misinformation and disinformation are prevalent among conservatives and progressives. We create these bubbles around us that provide us with information that confirms our biases. We read it, and it gives that dopamine hit we need.

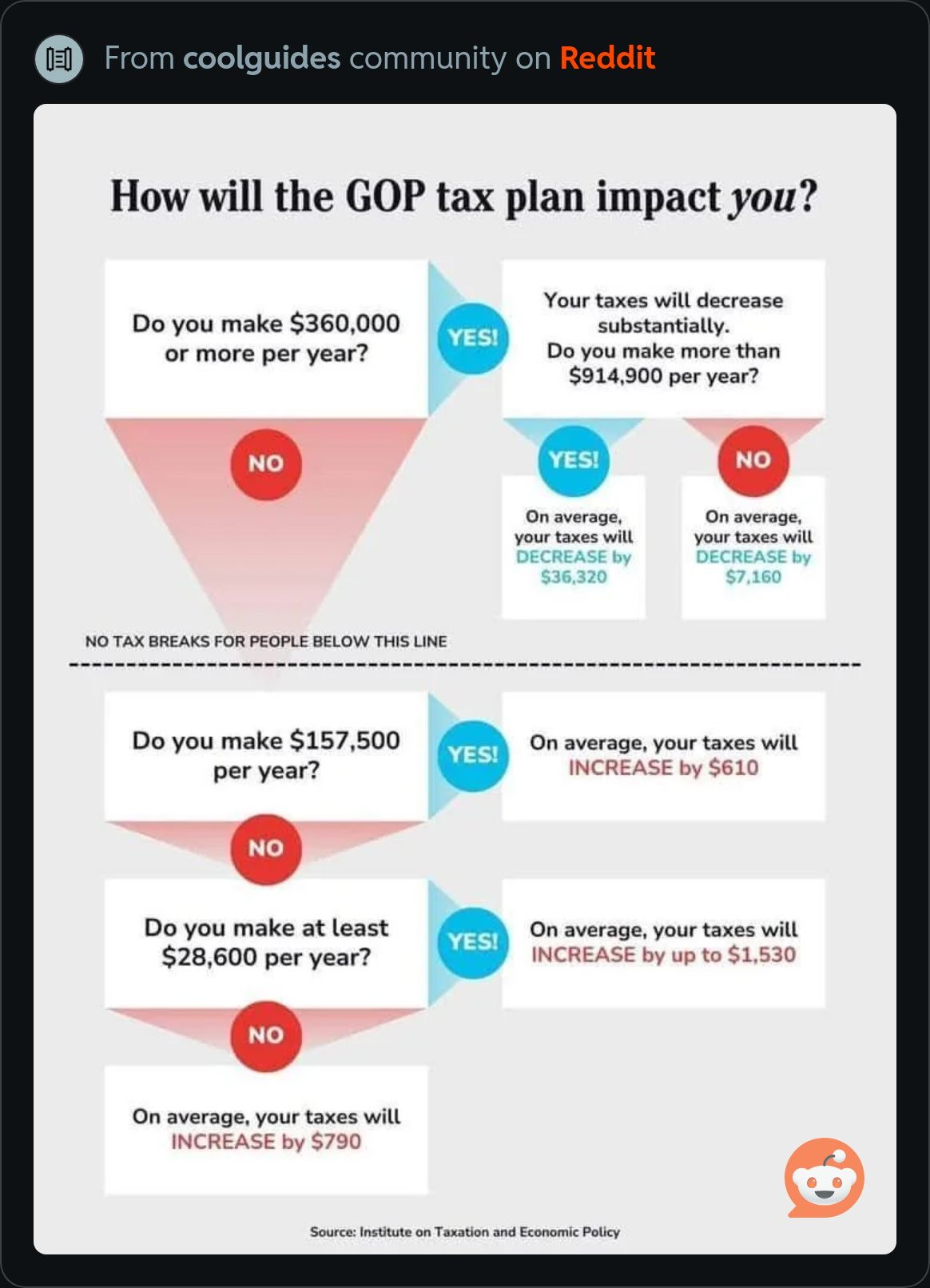

With the House passing its budget, I saw an uptick in posts on Reddit related to the “GOP tax plan,” often with an infographic about it. What I found interesting about the infographics is that they were misleading about what the plan includes. Here’s a good example of what I’ve seen. This one was posted to r/coolguides.

You’ll notice that the infographic cites the Institute on Taxation and Economic Policy (ITEP) as the source. In October, ITEP published a distributional analysis of Trump’s tax plan. The infographic appears to have used this publication to create the analysis. The Trump tax plan isn’t necessarily the “GOP tax plan.” The reason I say that is because a) the ITEP notes that this is Trump’s plan and b) the distributional impact includes pledged 20 percent tariffs on all countries and the 60 percent tariffs on China.

Obviously, the landscape on tariffs has changed a little since Trump took office. We’re still waiting to find out what the full impact will be. That’s unclear right now, although we know that the poor and middle class will bear the brunt of tariffs. However, Congress won’t likely impose tariffs as part of its tax plan. Instead, tariffs will be imposed solely by the Executive Branch. If taxwriters tried to include the crippling tariffs that Trump is pursuing, I doubt it would get enough Republican votes to pass.

To be clear, tariffs are taxes, and they’re economically destructive. As former House Ways and Means Committee Chairman Kevin Brady (R-TX) once said, “Tariffs are taxes. Lower is better. Zero is best.” But a distributional analysis of the extension of only the Tax Cuts and Jobs Act (TCJA) shows that the lower quintiles of income earners stand to see the largest percentage tax cut, and it’s not only a tax cut for millionaires and billionaires.

Now, to the budget. Last week, the House passed H.Con.Res. 14, which provides instructions to committees to develop recommendations for legislation under budget reconciliation. Because the extension of the TCJA is projected to cost $4.6 trillion, not including other tax cuts that could be included, Republicans have to find offsets to reduce the impact on the budget deficit. Senate Republicans are discussing changing the way the Congressional Budget Office (CBO) would score the extension of TCJA. Rather than assuming the TCJA expires at the end of tax year 2025, under current law, Senate Republicans want the CBO to assume the TCJA is extended. That eliminates the constraints of budget reconciliation and could lead to the TCJA being made permanent outside the FY 2026 through FY 2035 budget window.

Democrats seized on the deficit reduction target of $880 billion over ten years given to the House Energy and Commerce Committee, which has Medicaid in its jurisdiction. The instruction helped Democrats create the narrative that “Republicans are passing tax cuts for billionaires by cutting Medicaid.” Republicans defended the instruction to Energy and Commerce by saying that the word “Medicaid” didn’t appear in H.Con.Res. 14 at all and that the committee has a substantial jurisdiction. While that may be true, Medicaid is 93.4 percent of the mandatory spending in the jurisdiction of Energy and Commerce over the next ten years.

Republicans aren’t wrong that Medicaid never appears in the budget resolution. That said, a menu of potential cuts was obtained by The New York Times that listed hundreds of billions of dollars in potential changes to Medicaid.

Trump has said he doesn’t want to cut Medicaid. Congressional Republicans are, to some degree, backing away from the potential bigger changes to Medicaid. Presumably, that includes per capita caps, limiting the amount the federal government contributes to states. States would have to come up with funding if the caps are exceeded. This is a reform that is needed, although it can be done in different ways to achieve savings, but the other ways of doing it fall far short of $900 billion.

However, the $50.3 billion in improper payments made by Medicaid (FY 2023) will be targeted. That’s easier said than done, though, because not all improper payments are fraudulent. The Centers for Medicare and Medicaid Services explains, “These payments typically involve situations where a state or provider missed an administrative step and do not necessarily indicate fraud or abuse.” Republicans will also likely push work requirements for able-bodied adults.

There are ways to get to the $880 billion target–again, that’s over ten years–but it’s hard to do without some of the changes to Medicaid that equate to cutting benefits. Two other Medicaid changes with big savings that could be considered are lowering the Medicaid federal medical assistance percentage (FMAP) floor of 50 percent and equalizing the FMAP for the Medicaid population under the Affordable Care Act (ACA).

States with higher per capita incomes get fewer Medicaid dollars, but the floor is 50 percent. States that tend to be at the floor are New York, California, and Massachusetts. Poorer states get a higher percentage, up to the maximum of 83 percent. These states include Mississippi, Kentucky, and West Virginia. If the FMAP floor were lowered, state legislatures in states already at the floor would have to come up with the money to ensure that the Medicaid population remains covered. That likely means revenue increases. This also may make Republicans from New York, California, New Jersey, Washington, and other states very nervous about voting for a bill that likely hurts their states.

Under the ACA, states that expanded Medicaid to adults who earning up to 138 percent of the federal poverty line. The federal government covered the full amount of the expansion population for three years before gradually reducing the FMAP to 90 percent, where it is today. More than 40 states have expanded Medicaid for this population, including traditionally Republican states like Arkansas, Idaho, Indiana, Kansas, Louisiana, Montana, Nebraska, Ohio, Utah, and West Virginia. There are also competitive states like Arizona, Michigan, Nevada, North Carolina, and Pennsylvania.

Reducing the FMAP for the ACA population means taking it from 90 percent to 50 percent. States will then have a choice of using state dollars to make up the shortfall to keep the Medicaid expansion population covered or repealing expansion, leaving the expansion population uncovered. (To be clear, a crowd-out effect is likely. Some of these individuals may otherwise have private insurance without Medicaid. I’ve seen estimates from 15 percent to as high as 50 percent.) Some states already have laws in place to eliminate Medicaid expansion should the FMAP ever fall below 90 percent. Virginia, for example, has such a law. Of course, the possibility of the FMAP being reduced at some future date is why some states, like Georgia, didn’t expand Medicaid.

The task Republicans face isn’t an easy one. There are a number of landmines they must dodge to get an extension of TCJA through Congress. It won’t be easy. That’s not to say it can’t or won’t be done. Achieving $880 billion in savings over ten years from the Energy and Commerce Committee without cutting Medicaid benefits or eligibility for benefits is just one of those landmines.