The Former President's Record on Spending, Deficits, and Debt

Answering a Question from a Reader

A friend and reader recently sent me a tweet from @NumbersMuncher (below) that demonstrates fiscal profligacy under Trump. The friend asked, “I saw this tweet back when I was still on Twitter back in 2021. It’s a claim from someone who I don’t know, who is claiming….that Trump was going to add on $3.5 trillion dollars to the national debt before Covid. This is something that I’ve tried to tell certain conservatives to hopefully make them re-think their ridiculous devotion to Trump. I got to thinking though…..I got this from only one source. I’m wondering…..was this source I’ve been quoting fully correct?”

Since racism and the Confederacy have been talked about lately (thanks, Nikki Haley), I was going to dedicate some time to those two topics. Because this request about spending and Trump is coming from a friend, it takes precedence.

So, the answer is “yes,” the tweet is accurate. However, as much as I dislike Trump (and will never vote for him), there’s key context missing that should be provided. For proper background, I’m going to use historical budget data beginning in 2003 through 2022. That gives us 20 years of context to consider as we fully answer the question.

Here’s why I say the tweet is true. The data say so, as you can see below. (FY 2017-FY 2019 are in orange. No pun intended.) The budget deficit in FY 2017 was lower than claimed in the tweet, but it was $665.4 billion. In FY 2018 and FY 2019, the budget deficit was $779.1 billion and $983.6 trillion. The pre-COVID-19 projection was $1.015 trillion, according to the Congressional Budget Office's (CBO) January 2020 ten-year projections. As for Trump’s pledge that he would eliminate the national debt, he did make such a statement. No one took it seriously, except for maybe those in the cult of Trump.

For comparison, I’ve provided the Congressional Budget Office’s projections from January 2017 and compared them to the actual budget figures from the CBO’s historical data. Those data are below. Projections are (P) and the actual data is (A). Revenues come in lower than the projections because of changes to the tax code, including the Tax Cuts and Jobs Act, while discretionary outlays came in much higher in dollar terms.

Those of us who research and write about the federal budget, appropriations, and spending tend to look at the number through the lens of percentages of gross domestic product (GDP). I’ve gone almost blind over these subjects lately. I’ve written about it so much for my second job. Here’s the basic look of FY 2003 through FY 2022 just in the context of outlays, revenues, and deficits.

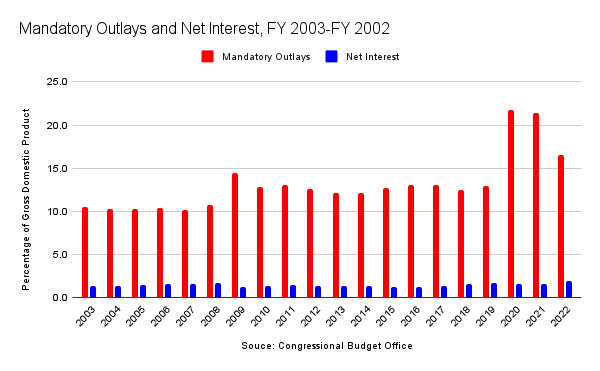

Let’s take a look at outlays. Now, outlays consist of three buckets of federal spending—discretionary, mandatory, and net interest. Discretionary consists of defense and nondefense spending. This is what Congress argues about every year. Mandatory outlays and net interest are based on the programmatic and debt service obligations that the federal government has. These outlays are essentially on autopilot. Congress doesn’t touch them. Mandatory spending, by the way, includes outlays for Medicare, Social Security, Medicaid, federal civilian and military retirement, and veterans’ programs.

As you can see, discretionary spending generally declined as a percentage of GDP from FY 2010 through FY 2018. Discretionary outlays did slightly rise in FY 2019. At the time, many of us in the conservative and libertarian policy spaces criticized the discretionary spending increases under Trump. In sheer dollar terms, the increases were concerning at the time. Relative to GDP, the increases aren’t as big of a deal. That being said, we’re talking about a $152.4 billion increase from FY 2017 through FY 2019 when compared to FY 2016. I do put the responsibility on Trump for FY 2017 because he was in office when the omnibus was signed into law in May 2017. The reason many of us were concerned about the increases was Congress was running larger deficits during a time of general peace and decent economic growth when the deficit should’ve been lowered.

Changing gears, and going back to percentages of GDP, the deficits under Trump before COVID-19 were predominately caused by two factors: 1) increases in mandatory outlays and net interest and 2) tax cuts that reduced revenues. The increases in mandatory spending and net interest weren’t massive, but they were enough to take outlays for these parts of federal spending from 14.4 percent in FY 2017 to 14.7 in FY 2019.

In dollar terms, we’re talking about a $441.9 billion increase in mandatory spending and net interest. That’s combined.

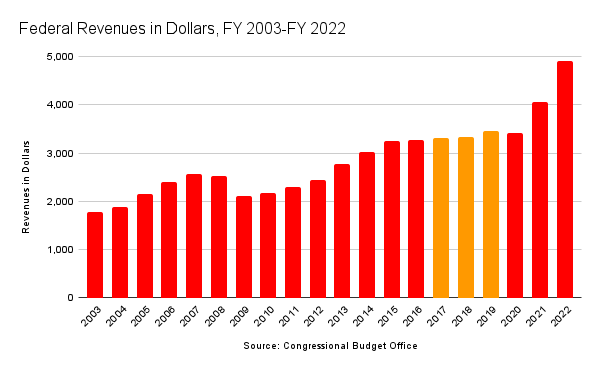

Revenues are where this gets tricky. Most conservatives and libertarians want tax cuts, myself among them. However, it’s hard to look at the budgetary picture and say that losses of revenue weren’t responsible for the increases in deficits under Trump. The decline in revenues was predominately driven by declines in corporate income tax receipts. What about individual income tax receipts? Eh, not really. Individual income tax receipts were 8.3 percent of GDP in FY 2016 compared to 8.3 percent in FY 2018 and 8.1 percent in FY 2019. Sure, individual income tax revenues went down as a percentage of GDP, but not by much.

Using dollars, revenues grew by $195.4 billion from FY 2017 through FY 2019 compared to FY 2016.

Trump spent more than he should have, no question. He added $2.633 trillion to the share of the debt held by the public between FY 2017 and FY 2019. The debt held by the public as a share of GDP went from 76.2 percent in FY 2017 to 79.4 percent in FY 2019. Add in FY 2020, Trump’s contribution to the share of the debt held by the public jumps to $6.849 trillion. In FY 2020, debt as a percentage of GDP hit 99.8 percent. (As an aside, does anyone remember when he wanted $2,000 stimulus payments? The person who stopped that awful idea was Senate Majority Leader Mitch McConnell.)

Was Trump fiscally responsible? No, he wasn’t. Did he care about the national debt? Absolutely not. However, there’s a lot of context missing from the tweet that needs to be provided. Thanks to the reader for sending this in. Let me know if you have any questions about what I’ve shared.