Vivek Ramaswamy Appears to Know Little About Budget Deficits and Debt

Economic Growth Alone Won't Solve Our Problems

In past posts, I’ve said that I can’t and won’t vote for Donald Trump or Florida Gov. Ron DeSantis for president if either of them wins the Republican nomination. I don’t care to revisit those reasons in this post except to say that I’m tired of the strain of populism and authoritarianism that has infected the Republican Party. As I’ve said to friends privately, I’d vote for any other Republican in the field. However, I have to add another name to my “can’t and won’t vote for” list.

A few weeks ago, my girlfriend and I were watching TV. We had CNN on, but neither of us was really paying much attention to it. We were talking or surfing our phones when Vivek Ramaswamy joined the program. I haven’t been able to find the video of his appearance, but Ramaswamy was asked about entitlements, and he said something along the lines of how annual growth of gross domestic product of 3 percent to 4 percent would solve America’s economic problems. I couldn’t help by react by saying, “That’s bullshit, and he knows it.” My girlfriend laughed.

Since I couldn’t find the video, I took a peek at Ramaswamy’s campaign website. Indeed, there’s a section about the economy, which states: “With his plan to achieve over 5% GDP growth, Vivek is proposing bold and innovative policies that will foster entrepreneurship, create jobs, and drive sustained economic growth for all Americans.”

Well, 5 percent GDP growth is a very bold goal. Ramaswamy doesn’t say a ton about what he’d do to achieve 5 percent growth. Don’t get me wrong. He says the right things, such as reducing regulation, dismantling the Great Society, and incentivizing trade schools. He doesn’t explain how this would achieve 5 percent growth. Even if someone were to magically “dismantle” (his word) the Great Society, it would have to be replaced with something else. Remember, the Great Society includes Medicare and Medicaid. That makes his skirting cuts to entitlements very weird. So, when he talks about 5 percent growth, I’m just skeptical.

Let’s establish a few things. First, economic growth has lagged since just after the turn of the century. From 2001 through 2022, the real annual GDP growth rate averaged 1.9 percent. From 1948 through 2000, real annual GDP growth averaged 3.6 percent. Some may be quick to point out that we saw periods of high taxation between the 1940s and the early 1980s. However, we also saw a substantial tax cut in the 1960s that was pushed by President John F. Kennedy and, after he was assassinated, President Lyndon B. Johnson. The top income tax rate was cut from 91 percent in 1963 to 77 percent in 1964. The 1960s saw average annual GDP growth of 4.3 percent, which is the largest annual GDP growth rate of any decade between 1951 and 2020.

Now, between 2001 and 2021, the United States saw only three years—2004 (3.9 percent), 2005 (3.5 percent), and 2021 (5.9 percent) in which annual real GDP growth exceeded 3 percent. The good news is that the rebound from the COVID-19 pandemic was swift. We made up the GDP we lost and then some. The bad news is that it had been 16 years since we’d seen GDP growth above 3 percent.

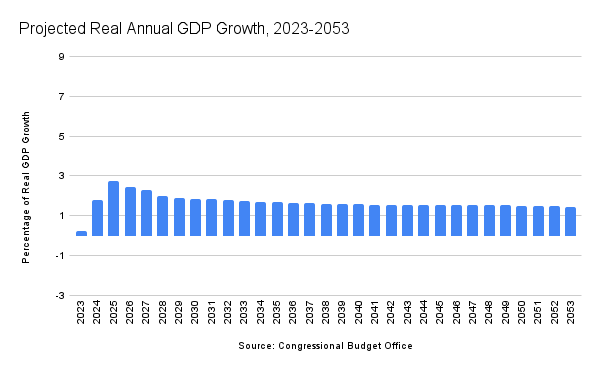

Second, real GDP growth is expected to be relatively anemic in the future. Few people seem to really understand how exceedingly screwed we are. The next 30 years are expected to look much like the past 21 years, with average real annual GDP growth of 1.7 percent. Yeah, not great.

Lastly, revenues over the next 30 years are projected to be higher as a percentage of GDP than they’ve been in recent memory. Even when the United States had historically high income top income tax rates, tax collections as a percentage of GDP weren’t insanely high. From 1941 to 1960, total receipts averaged 16 percent of GDP. Since 1951, the fiscal year with the largest receipts relative to GDP was 2000, at 20 percent. Few of us would look back on the economy of the late 1990s and 2000 with anything but admiration.

However, tax receipts are projected to grow from 17.8 percent in FY 2024 to 19.1 percent in FY 2053. Mandatory spending, which includes entitlement programs, isn’t static and will take up more resources as well, with the federal government spending on mandatory programs equaling nearly 17 percent of GDP. Add in interest on the national debt, we’re at 23.6 percent of GDP. This is a little over what the federal government spent relative to GDP in FY 2009, when spending was disproportionally high as the Bush and Obama administrations used Keynesian economic principles to respond to the Great Recession. So, we’re already at a budget deficit, and we haven’t even factored in discretionary spending.

I hate math as much as the next person, but we’re going to have to get to the crux of just one of my issues with Ramaswamy. Federal spending as a percentage of GDP is projected to be 29.1 percent in FY 2053. Obviously, to balance the budget, we’d need the same amount in revenues. Since 1930, the federal government has collected receipts at or above 20 percent of GDP only two times, in 1944 and 2000. Even if tax receipts were 25 percent of GDP in 2053, we’d still have a $3.2 trillion budget deficit, or a little over 4 percent of GDP.

Nick Gillespie recently mentioned Ramaswamy’s weird posture on economic growth. He wrote, “In a recent report, CBO estimated that for every 1.2 percentage points that GDP exceeds its projected level for 2033, the deficit would be $51 billion smaller in that year. By that measure, if GDP growth ran 4 percent instead of 2 percent over those eight years, the projected deficit in 2033 of $1.4 trillion would be cut roughly in half, to $700 billion.”

We need pro-growth policies—less regulation, tax reform, and discretionary spending cuts—but we’ve got to have common sense along with it. That means that we have to address mandatory spending and entitlement programs. Republicans like Ramaswamy aren’t going to do anything about it.

But there’s much more to Ramaswamy than his really bad take on the federal budget. He’s basically auditioning to be Trump’s running mate. He’s pledged to pardon Trump should he be convicted and sued the Department of Justice to get access to records related to the case against Trump. Granted, the pardon wouldn’t touch the state cases against Trump in New York and the looming indictment in Georgia. Ramaswamy is also trying to appeal to the reactionary base of the Republican Party by throwing red meat related to the culture war, including just today calling Juneteenth a “useless” holiday. These are just examples of the silliness coming from his campaign.

I heard Ramaswamy say that he can unite the country. Cozying up to Trump by promising a pardon while calling a holiday that celebrates the end of slavery in Texas, in addition to frequently touching on other culture war issues, doesn’t seem like the way to do that.

Finding a candidate who will reduce mandatory spending and entitlement programs might seem like a pie in the sky fantasy. Can you imagine a candidate winning by telling voters they will cut or reduce programs like Social Security, SNAP, SSI, refundable earned income tax credits, child tax credits, Veteran programs, or any federal programs to reduce poverty? It’s like saying “No soup for you!” to the voters. The GDP analysis seems spot on, so growing out of this conundrum is going to be difficult at best without "addressing" those problems. But once the masses start raiding the treasury, it might be hard to stop them until it’s all gone. I was never great at math so I cannot strike Ramaswamy yet. The one thing I really like about him is that he isn't 90 years old, that alone makes me keep an eye on him.