No, the Federal Government Hasn’t Run a Surplus in FY 2025

Blame my barber's other customers for this post

Before diving into a quick rant, let me note that I have, like, three posts planned. The question is, when will I get them done? I’m going to try to knock out at least one more before the weekend is over. My Significantly Better Half™️ has made plans for our Saturday, and we’re going to see the Richmond Flying Squirrels play on Sunday.1 I can get another post done, right? Anyway, to the point of this post.

If you’ve followed along here since I started, you know that at least a decent number of posts I write come from conversations with people with whom I interact. Earlier today, I got a haircut. My barber and her husband are great people. They’ve become good friends. If I don’t make it in for more than the usual two or three weeks I wait between haircuts, it’s not out of the ordinary for one of them to text to make sure I’m okay. They truly are good people, even if I call my barber’s husband a “communist” when I see him.

They know what I do for a living. Inevitably, our conversations end up with us discussing politics. I forget exactly how we got on the topic, but I recall her husband making a comment about the so-called “One Big Beautiful Bill Act” (OBBBA) will grow the deficit. “Yep, $4.1 trillion,” I replied. My barber then told me that I “wouldn’t believe how many people come in and say that the tariffs are creating a surplus.” I ranted. Man, I ranted.

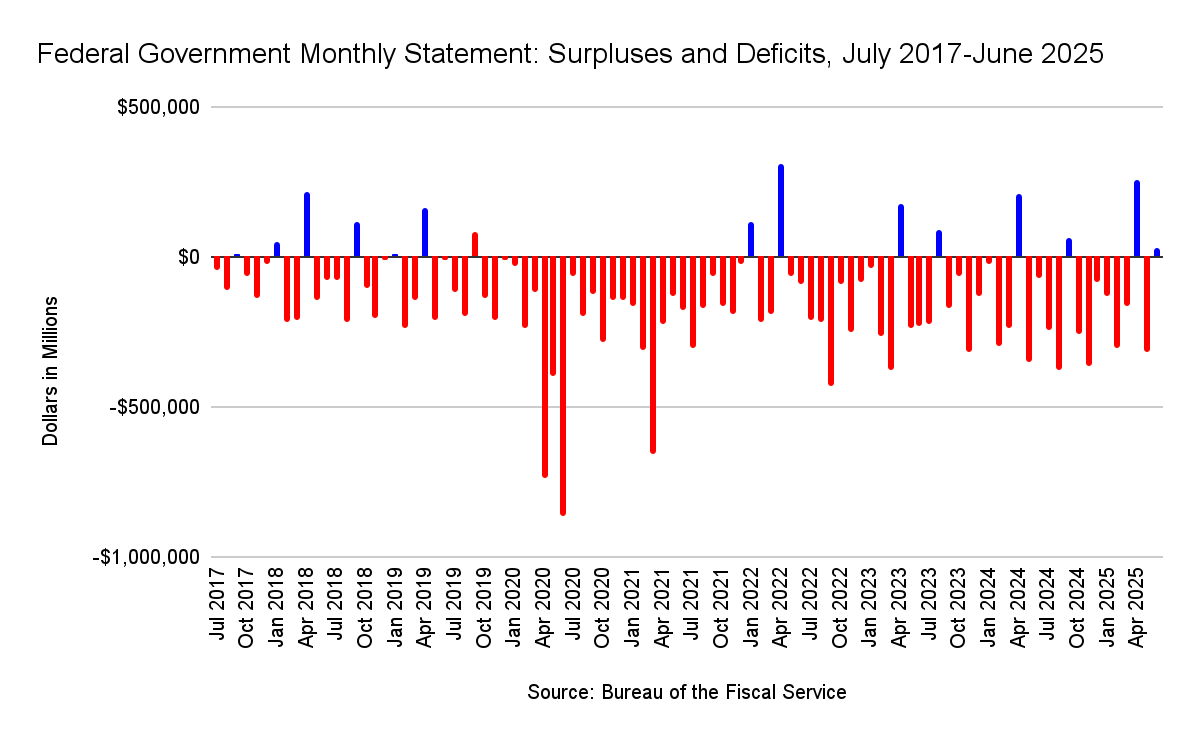

Let me say this now. The budget deficit for FY 2025 is $1.339 trillion. That’s how much more the federal government has spent than it has collected in revenue. There was, however, a surplus of $27 billion in June. This isn’t the first time the federal government has had a surplus in a month. It’s not even the first time this fiscal year the federal government has run a surplus. Granted, we tend to see the federal government run surpluses in April in non-recession years.2 We’ll also sometimes see surpluses in September.3 We do see surpluses at other times, like we saw in June. The federal government ran a surplus of $89.3 billion in August 2023, for example.

That said, the federal government has run a surplus in only 139 out of the last 537 months4 and 14 out of the last 96 months.5 In other words, don’t get too excited.

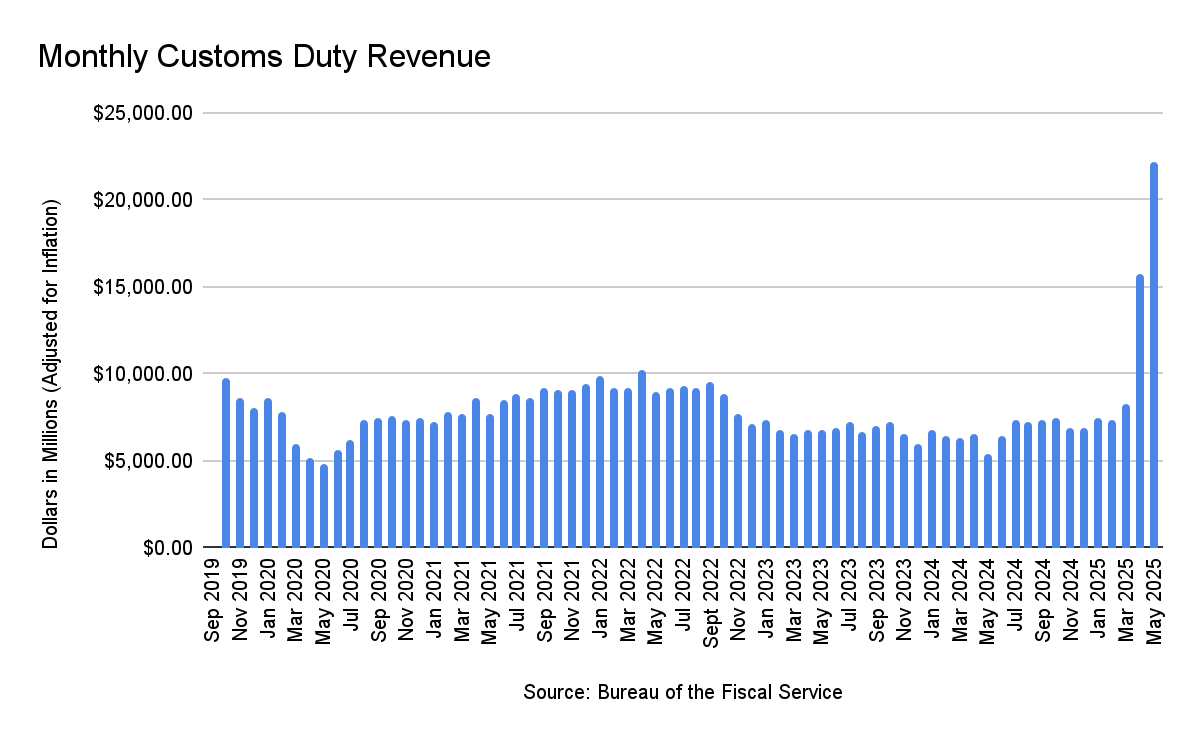

But why has the federal government run a surplus? Well, my barber tells me that those who have mentioned it say it’s the tariffs that Trump has imposed. Let’s take a step back for a moment and forget that tariffs are a tax on imports that are ultimately passed on to the consumer. Let’s just ignore that part of basic economics.

Receipts from customs duties have gone up significantly, according to the Monthly Treasury Statement from the Bureau of the Fiscal Service. Receipts have grown from $7.5 billion in January to $26.7 billion in June. The estimate for FY 2025 was $63.3 billion in customs duties. Through June, $108 billion has been collected. The difference is $52.4 billion compared to FY 2024, and there are still three months left in FY 2025.

So, why did the federal government run a surplus in June? Well, the Congressional Budget Office explains, “[O]utlays for June 1, 2024, and June 1, 2025, were shifted into May of those years, although the shift in 2025 was larger by $4 billion. If not for those shifts, the government would have recorded a deficit of $71 billion in June 2025–less than half the size of the deficit that would have been recorded in June of last year ($164 billion).”

In perspective, the deficit in FY 2025 is, as already noted, $1.339 trillion. I mean, I suppose the tariffs have made a dent, but it’s not something to get excited about. Keep in mind that the deficit projection for FY 2025 is $1.865 trillion. Will it actually be that high by the time FY 2025 is done? Hard to say.

But here’s the thing I want you to keep in mind. Federal spending remains $320 billion higher than it was at the same time in FY 2024. The top five programs or categories of federal spending account for roughly 71 percent of total federal spending. Four of those programs or categories are on autopilot. Only one is discretionary and, thus, subject to congressional appropriation.

Now, remember that tariffs are passed on by companies that import goods into the United States to the consumer.6 While the tariffs may generate additional revenue, their full impact will be detrimental to the economy overall. You will pay more when you buy things at the store. We’re beginning to see signs of this now that businesses are clearing out their pre-tariff stock. Inflation went up slightly in June, which is why the Federal Reserve hasn’t cut interest rates. Things aren’t great, and we have at least $4.1 trillion of deficits to add to our problems through FY 2034. So, that “net interest on the debt” category of federal spending. Yeah, it’s going to get worse.

I strongly encourage you to see Minor League Baseball if you have a team near you. As much of a baseball fan as I am, I appreciate the minors much more. This is something that has happened since I got into my 40s.

I mean, April is when most of us file our taxes, so this is to be expected. The surplus in April 2025 was $258.4 billion.

There was a surplus of $64.7 billion in September 2024.

Dating back to October 1980.

Going back to October 2017.

I’m reminded of a quote from former House Ways and Means Committee Chairman Kevin Brady (R-TX), “Tariffs are taxes. Lower is better. Zero is best.”