Senate's OBBBA Has a Larger Impact on the Deficit Than the House Version

Senate bill increases deficits by $755 compared to the House bill

The Senate advanced the so-called “One Big Beautiful Bill Act” (OBBBA), H.R. 1, on Saturday evening after some dramatics. Sens. Rand Paul (R-KY) and Thom Tillis (R-NC) were the only two Republicans to vote against the motion to proceed, a procedural motion that allows the Senate to “get on the bill.” Sen. Ron Johnson (R-WI), who’d complained about the increase in the deficit caused by the OBBBA, initially voted against the bill but later changed his vote to allow the bill to advance.

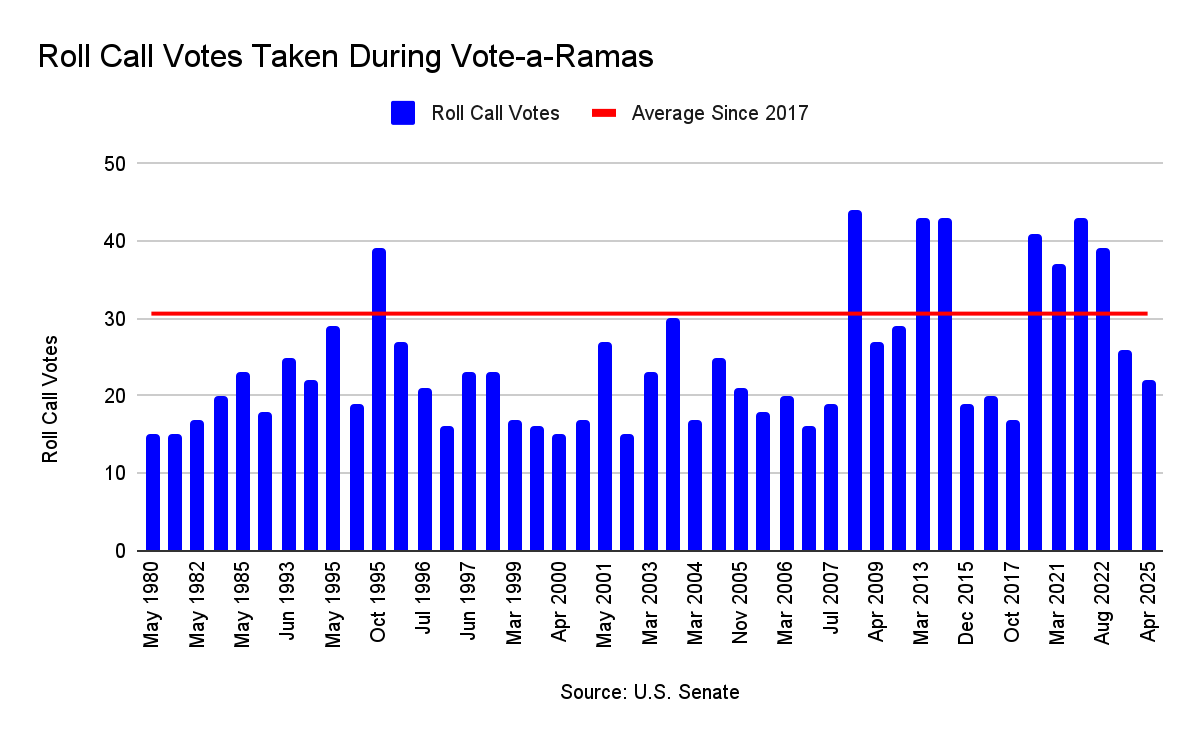

So, the Senate is now considering OBBBA, and vote-a-rama is expected to begin Sunday evening and conclude on Monday morning. This is a period of theoretically unlimited amendments to the base text of the bill. The average number of roll call votes in the eight vote-a-ramas since January 2017 is roughly 31.

My understanding is that the Senate version of OBBBA will be offered as a wraparound amendment at the end of the vote-a-rama. This could potentially negate any amendments previously adopted during the vote-a-rama, such as one that strips out the AI moratorium language. Whether an amendment makes it into the wraparound amendment would really depend on whether votes hinge on final passage. I’ve consistently advised in conversations about the bill that you have to start from the perspective that OBBBA will pass, regardless of what’s in the bill.

Still, there isn’t much room for error. Paul has said he will vote against OBBBA because of the $5 trillion increase to the statutory debt limit. Tillis, who announced Sunday morning that he won’t seek reelection, is a presumed no on final passage. However, Sen. Josh Hawley (R-MO), for all of his whining about Medicaid cuts, will vote for OBBBA. (I’ve never seen a statement like Hawley’s before. You should read it.) Sen. Lisa Murkowski (R-AK) got exemptions for Alaska in exchange for her vote. Johnson will almost certainly vote in favor of the bill. Sen. Susan Collins (R-ME) is still undecided, but her vote likely doesn’t matter because a tie means passage, anyway.

The Senate OBBBA Is Somehow Worse Than the House Version

Ordinarily, the CBO uses current law when estimating the budgetary impact of legislation. Under current law, the individual tax cuts under the Tax Cuts and Jobs Act (TCJA) of 2017 expire at the end of tax year 2025. This is why the projected deficit impact of the House version of OBBBA was roughly $3 trillion.1

The CBO is using a “current policy baseline,” which assumes TCJA doesn’t expire. Crapo is using this accounting gimmick to allow the Senate to stay within its budget reconciliation instructions. For example, the CBO’s estimate of the budgetary impact of OBBBA released on June 28 shows an decrease in the deficit of $508 billion over ten years. That’s complete nonsense.

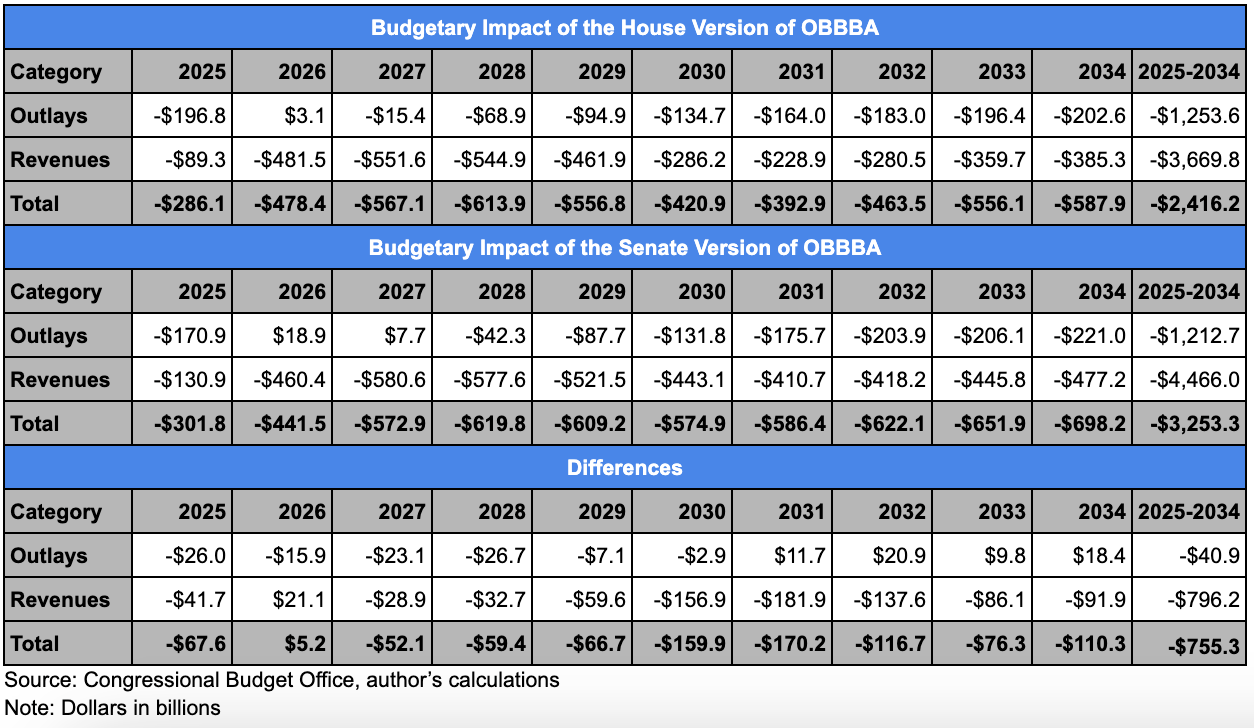

There was concern that we may not see the real estimate showing the true budgetary impact of OBBBA. Thankfully, the CBO released an estimate relative to the January 2025 baseline, which reflects current law.2 As shown in the table below, the Senate version of OBBBA would add $3.253 trillion to the deficit over the next ten years. (The “Total” is the increase in the deficit. I realize it’s a negative, but it’s an increase in the deficit.) That’s $755 billion more than the House version of the bill. Importantly, neither of these includes interest costs.3 Add in the interest costs, and the deficit impact is nearly $4 trillion over ten years.4

Only 23 percent of the deficit reduction in the Senate version of OBBBA is projected to occur in the first five fiscal years, through FY 2029. The remaining 77 percent of the deficit reduction occurs from FY 2030 through FY 2034. The likelihood of those savings taking place, just based on congressional behavior, isn’t high.

Add in interest costs, OBBBA increases budget deficits by $3.914 trillion over ten years. The chart below reflects increases in the budget deficit.

It’s hard to gauge the impact of the 16 expiring provisions. The estimate from the Joint Committee on Taxation used to calculate the total in previous posts was relative to the House version of OBBBA. I haven’t had time to do a comparison to see what the major differences are between the expiring provisions of the two versions.

Either way, OBBBA’s total deficit impact will likely exceed what the CBO reported. Also, it’s worth noting that this is based on the version of OBBBA posted on the Senate Budget Committee’s website on June 28 and may not include changes made between then and final passage.

What Happens If the Senate Passes OBBBA?

Should the Senate pass OBBBA either tonight or early Monday morning, the House may not immediately return to Washington, DC to vote on the bill. Speaker Mike Johnson (R-LA) is facing some problems with his whip count right now. A conference committee between the House and the Senate, though, is unlikely, but I suppose it’s not completely out of the question if conservatives hold the line against the Senate version of OBBBA. However, every single time conservatives have railed against OBBBA, they’ve still voted for it, except for Reps. Thomas Massie (R-KY) and Warren Davidson (R-OH).

In other words, take the saber-rattling with a grain of salt.

Excluding the deficit impact of extending the 16 provisions that begin to expire in FY 2029. If you include those provisions in the math, the deficit impact of OBBBA is just under $4.4 trillion. I didn’t include the interest costs of extending those provisions. The expiring provisions are relative to the House version of OBBBA.

The Joint Committee on Taxation also released estimates under current law and the current policy baseline.

These are conventional revenue estimates only. I’m not using the dynamic estimate of the House bill. We’re comparing apples to apples here.

The House-passed bill would have $551 billion in new interest costs, bringing the total hit to the deficit to $2.967 trillion over ten years. The Committee for a Responsible Federal Budget (CRFB) estimates $690 billion in new interest costs. That brings the deficit impact of the Senate version of OBBBA to $3.943 trillion. I used the CBO’s interactive tool to estimate the interest costs myself and got $661. My guess is CRFB has tweaked the interest rates to more accurately reflect borrowing costs while I didn’t touch that.